Medicare is a vital healthcare program that provides coverage for millions of Americans aged 65 and older, as well as certain individuals with disabilities or specific medical conditions. As understanding the nuances of this complex system is crucial, we have compiled a comprehensive guide to unravel the mysteries of Medicare. Whether you are nearing retirement age, looking to enroll for the first time, or simply seeking a better grasp of your existing coverage, this article aims to demystify the various aspects of Medicare, from its different parts and enrollment options to the costs, benefits, and supplemental plans available to beneficiaries.

Navigating the Medicare landscape can be challenging, but with the right knowledge, you can make informed decisions about your healthcare coverage. We will walk you through the basics, starting with the distinction between Original Medicare and Medicare Advantage, outlining the coverage provided by Medicare Part A, Part B, Part C, and Part D, and explaining how each component fits into the overarching Medicare framework. From there, we will delve into important topics such as Medicare enrollment periods, coverage options, and the additional benefits offered by Medicare Advantage Plans and Medigap policies. Understanding the eligibility requirements, costs, and benefits associated with these programs is essential for maximizing your healthcare coverage while minimizing out-of-pocket expenses.

Moreover, we will explore the intricacies of Medicare Prescription Drug Plans, acquainting you with the various options available to help offset the costs of critical medications. We will also shed light on the annual Medicare Open Enrollment period, during which you have the opportunity to review and modify your coverage to better suit your evolving healthcare needs. Additionally, we will discuss specialized plans designed for individuals with specific health concerns, such as Medicare Advantage Special Needs Plans.

Lastly, we will touch upon Medicare Savings Programs, which aim to assist eligible individuals with limited income and resources with their Medicare-related expenses. By shedding light on all these essential components, we hope to provide you with the knowledge and tools necessary to navigate the intricate world of Medicare and make well-informed decisions about your healthcare coverage.

Stay tuned as we unravel the mysteries of Medicare, equipping you with the comprehensive information you need to confidently navigate this critical healthcare program. Whether you are new to Medicare or a long-time beneficiary, this guide will empower you to make the best choices for your personal circumstances, ensuring that you receive the healthcare coverage you deserve.

Understanding Medicare

Medicare is a comprehensive health insurance program in the United States that provides coverage for individuals who are 65 years and older, as well as certain individuals under 65 with disabilities or specific medical conditions. It is important to have a solid understanding of Medicare and its various components in order to make informed decisions about your healthcare coverage.

The program consists of different parts, each covering specific services and expenses. Original Medicare, which includes Medicare Part A and Part B, is the foundation of the program. Medicare Part A mainly provides coverage for hospital stays, skilled nursing facility care, hospice care, and some home health services. On the other hand, Medicare Part B covers medical services such as doctor visits, preventive care, outpatient care, and medical supplies.

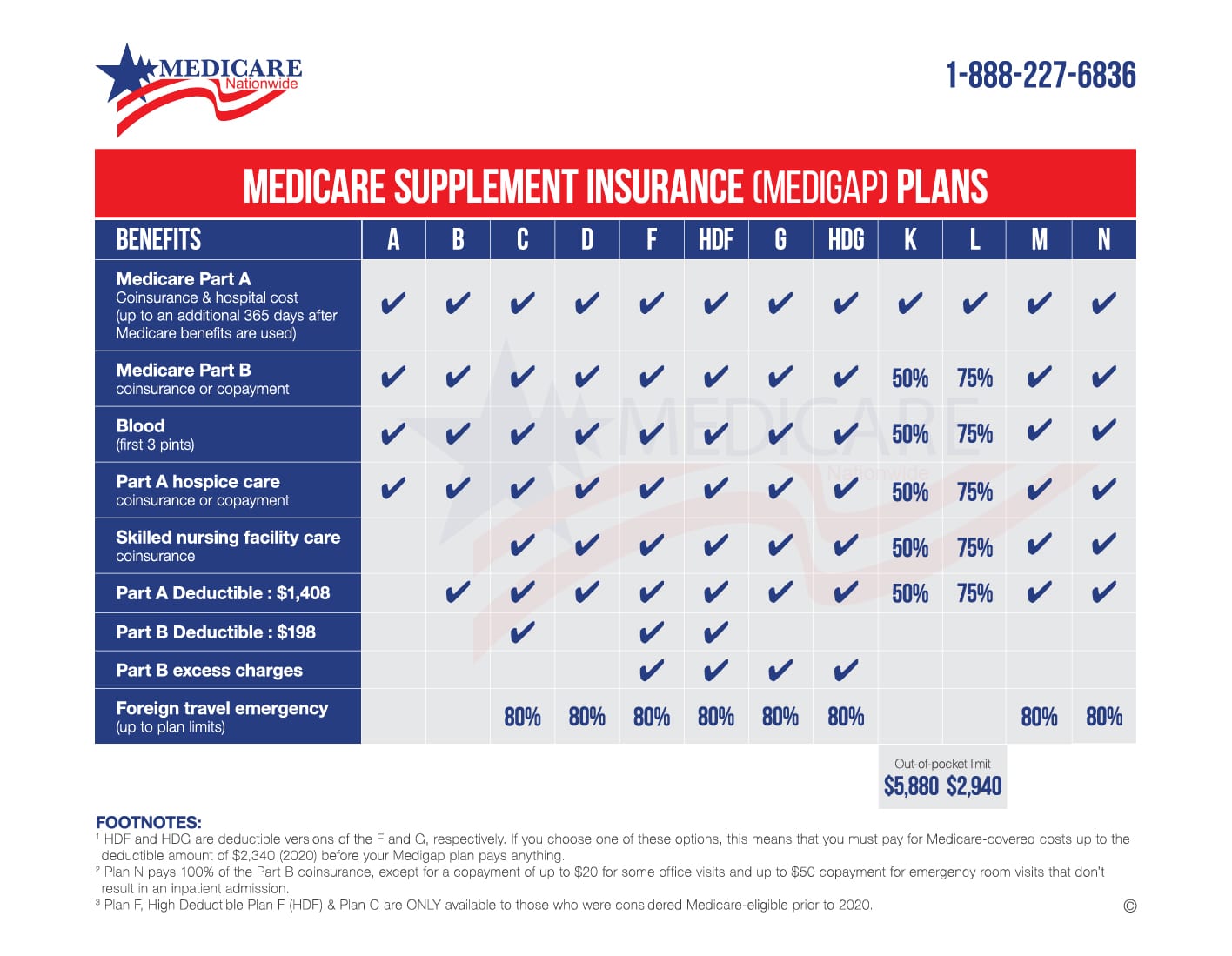

To expand their coverage beyond Original Medicare, individuals have the option to enroll in Medicare Advantage (Part C) or Medicare Supplement Plans (Medigap). Medicare Advantage plans are offered by private insurance companies approved by Medicare, and they provide all of the benefits of Original Medicare, along with additional services like vision, dental, and prescription drug coverage. Medigap plans, on the other hand, help cover certain out-of-pocket costs associated with Original Medicare, such as deductibles, copayments, and coinsurance.

Medicare also offers prescription drug coverage through Medicare Part D. This helps beneficiaries pay for medications prescribed by their doctors. It is important to note that if you have Medicare Advantage, prescription drug coverage is typically included in your plan.

Understanding the different enrollment periods and eligibility requirements for Medicare is crucial. You can enroll in Medicare during your Initial Enrollment Period (IEP), which usually begins three months before your 65th birthday and ends three months after. If Medigap Coverage Virginia miss your IEP, you can enroll during the General Enrollment Period, which runs from January 1 to March 31 each year, although a late enrollment penalty may apply.

In conclusion, Medicare is a complex health insurance program that aims to provide coverage for seniors and certain individuals with disabilities or specific medical conditions. By familiarizing yourself with its various parts, enrollment periods, and coverage options, you can make informed decisions about your healthcare needs and ensure you receive the appropriate benefits.

Medicare Enrollment and Eligibility

Medicare is a federal health insurance program that primarily serves individuals who are 65 years or older. However, it is also available to certain individuals with disabilities and those who have been diagnosed with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

To be eligible for Medicare, you generally need to be a U.S. citizen or a legal permanent resident who has lived in the country for at least five consecutive years. There are different parts of Medicare, each with its own enrollment requirements and coverage options.

Original Medicare, which is made up of Medicare Part A and Part B, is automatically available to most people when they turn 65. Part A provides coverage for hospital inpatient services, while Part B covers doctor visits, outpatient care, and preventive services.

Medicare Advantage, also known as Part C, is an alternative to Original Medicare and is offered by private insurance companies contracted with the Medicare program. To enroll in a Medicare Advantage plan, you must be enrolled in Parts A and B of Original Medicare. These plans often include additional benefits beyond what Original Medicare offers, such as prescription drug coverage and routine dental or vision care.

Additionally, Medicare Part D provides prescription drug coverage to individuals who have Original Medicare or Medicare Advantage. Part D plans are primarily offered through private insurance companies and require separate enrollment.

Understanding the enrollment and eligibility criteria for Medicare is crucial to ensure you can access the healthcare benefits you need. If you are approaching age 65, it is important to familiarize yourself with the enrollment process and timelines to avoid any coverage gaps or penalties. Remember, there are certain enrollment periods, including the initial enrollment period and annual open enrollment period, during which you can enroll in or make changes to your Medicare coverage.

By understanding the various parts of Medicare, their enrollment requirements, and the coverage options available to you, you can make informed decisions to meet your healthcare needs and stay financially protected.

Exploring Medicare Coverage and Costs

Medicare offers a variety of coverage options, ensuring that individuals can find a plan that suits their healthcare needs. From Original Medicare to Medicare Advantage, you have choices when it comes to your Medicare coverage.

Original Medicare consists of Part A and Part B. Part A covers hospital stays, skilled nursing facility care, hospice care, and some home health services. On the other hand, Part B covers medical expenses such as doctor visits, preventive services, durable medical equipment, and outpatient care. Together, these parts provide a solid foundation of coverage for eligible individuals.

Medicare Advantage, also known as Part C, is an alternative to Original Medicare. Offered by private insurance companies, Medicare Advantage plans provide all the benefits of Part A and Part B, and often include additional perks like prescription drug coverage, vision, dental, and hearing services. It's worth exploring these plans as they may offer more comprehensive coverage to meet your specific healthcare needs.

When it comes to costs, it's essential to understand how Medicare expenses work. Although Part A is generally premium-free for most beneficiaries, Part B requires a monthly premium. The premium amount may vary based on your income. Additionally, deductibles, coinsurance, and copayments may apply to both Part A and Part B services. It's crucial to consider these costs when budgeting for your healthcare.

Remember, Medicare Supplement Plans (also known as Medigap) can help cover some of the out-of-pocket costs associated with Original Medicare. These plans are offered by private insurance companies and can assist with expenses such as deductibles, copayments, and coinsurance. Exploring these options can provide additional financial peace of mind.

Understanding Medicare coverage and costs is vital to making informed decisions about your healthcare. Whether you choose Original Medicare with or without a Medicare Supplement Plan or opt for a Medicare Advantage plan, taking the time to explore your options and consider your budget is essential. Medicare's various programs and coverage options exist to support your health and well-being throughout your retirement years.